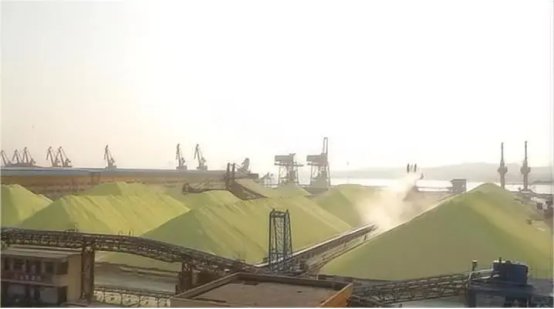

Recently, the price of sulfur, a key raw material for the production of many fertilizers, has continued to rise, causing significant fluctuations in the fertilizer industry. Since last year, sulfur prices have been on an upward trend, and this upward trend has continued this year. As a core raw material for sulfuric acid production, fluctuations in sulfur prices directly affect fertilizer companies.

1. Cost Pressure is the Most Direct Factor

1) Monoammonium Phosphate (MAP)

High Cost Proportion: Sulfur is the core raw material for phosphoric acid production, accounting for 30%-40% of the total cost of MAP. Direct Transmission Mechanism: The chain of sulfur → sulfuric acid → phosphoric acid → MAP is short, and price transmission is rapid. After the sulfur price increase in September 2025, MAP companies immediately responded to cost pressure by suspending order acceptance and raising prices.

2) Diammonium Phosphate (DAP)

Cost Structure Divergence: High-content DAP (e.g., 64% granules) contains approximately 23%-28% sulfur, lower than monoammonium phosphate (MAP); while low-content DAP (e.g., 57%) has a higher sulfur cost due to simplified production processes, making it more sensitive to price fluctuations. Demand Support Differences: High-content DAP is mainly used for exports and cash crops (e.g., corn, soybeans), with strong demand and relatively stable prices; low-content DAP is mostly used for field crops (e.g., wheat), with high demand elasticity and weak prices.

2. Compound Fertilizers: Type Differences Determine Impact

1) Sulfur-Based Compound Fertilizer

Cost Sensitive: Sulfur accounts for 38%-40% of the raw material cost of sulfur-based compound fertilizer. For every 100 yuan/ton increase, the unit cost increases by approximately 73 yuan. Enterprises are forced to reduce production or raise prices by 10%-15%.

2) Chlorine-Based Compound Fertilizer

Less Impact: Chlorine-based compound fertilizer uses ammonium chloride as the nitrogen source, with sulfur only used to adjust the sulfur content, accounting for less than 5% of the cost.

3) High-Nitrogen Compound Fertilizers

More significantly affected by urea: Urea accounts for approximately 30% of the cost of high-nitrogen compound fertilizers, while sulfur accounts for less than 10%. In the third quarter of 2025, the price of high-nitrogen compound fertilizers fell by 30-80 yuan/ton due to urea price reductions, masking the impact of sulfur price increases.

3. Other Fertilizers: Indirect Impact or No Direct Correlation

Urea: No direct correlation. Urea production uses natural gas or coal as raw materials and does not require sulfur; therefore, sulfur price increases have no direct impact on its costs.

Potassium Fertilizer: Limited indirect impact. Potassium fertilizer production does not involve sulfur, but sulfur price increases may indirectly suppress potassium fertilizer demand by affecting downstream agricultural costs.

Currently, the sulfur market presents a pattern of "tight supply and downstream pressure." If international supply (such as the recovery of Russian exports and the completion of maintenance on Canadian natural gas pipelines) falls short of expectations, while demand in emerging markets such as Indonesia and India remains strong, sulfur prices may remain high.