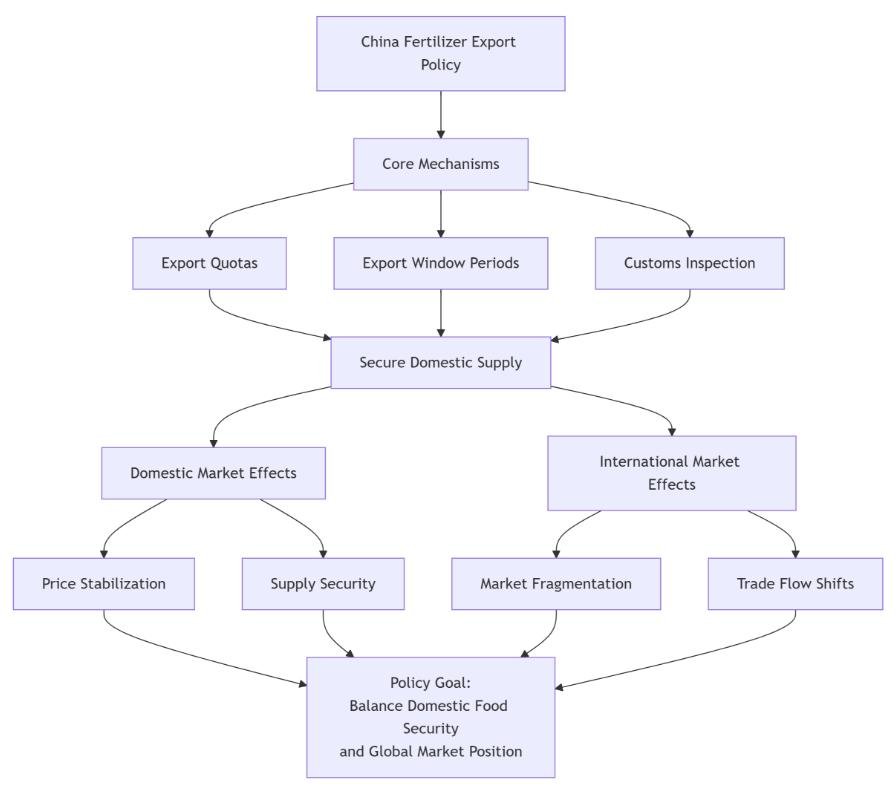

China's fertilizer export policy, centered on "domestic priority and appropriate exports," leverages quota management, price controls, and other tools to exert multi-dimensional influence on domestic and international markets and the industry landscape.

1. Tariff Quota Management: The total import tariff quota for fertilizers in 2025 is 13.65 million tons, including 3.3 million tons of urea, 6.9 million tons of diammonium phosphate, and 3.45 million tons of compound fertilizers. Quota allocation balances state-owned and non-state-owned trade, and is dynamically adjusted based on enterprises' quota utilization (verification rates) from the previous year, encouraging them to improve quota efficiency. Although specific export quotas have not been announced, export data for the first half of 2025 indicates a significant year-on-year increase in China's fertilizer exports, with ammonium sulfate, nitrogen-phosphorus compound fertilizers, and diammonium phosphate leading the way.

2. Export Window and Total Quantity Control: For fertilizer exports, the policy will establish a dedicated export window period, aligning it with the domestic agricultural off-season and the peak season for international market demand. Total export volume will be strictly controlled.

3. Export Legal Inspection and Process Optimization: All exported fertilizers must undergo statutory inspection. To improve efficiency, the policy allows companies to choose between factory and port legal inspections, and coordinates with customs to streamline procedures and shorten inspection cycles.

4. Domestic Prices and Supply: Total export volume controls and window period restrictions are designed to ensure domestic supply and stabilize prices during the critical farming season. Furthermore, export regulations for small-packaged fertilizers (gross weight not exceeding 10 kilograms) will be further tightened in 2025. This will curb the export of small-packaged fertilizers and ensure the supply of bagged fertilizers in the domestic market.

5. International Trade Flows: Under policy guidance, the destination structure of China's fertilizer exports has significantly shifted. Companies are encouraged to increase exports to traditional markets such as Southeast Asia (such as Bangladesh and Myanmar) and Africa (such as Ethiopia and Nigeria), while also exploring emerging markets such as the Middle East and Latin America.

Summary: China's fertilizer export policy, through a combination of quota management, price controls, and regional strategies, strikes a balance between ensuring domestic food security and participating in global fertilizer governance. In the short term, the policy will directly lead to price differentiation at home and abroad and increase industry concentration; in the medium and long term, it will promote the green transformation of the industry and diversified market layout.